How to Spy on Meta and Tik Tok Competitor Ads: The Complete Guide

Nov 27, 2025

|

10

min read

You've definitely wondered what your competitors are up to with their ads. What hooks are they using? Which audiences are crushing it? What creative angles are actually moving the needle?

Good news: everyone spies on competitor ads. Better news: there's a smarter way to do it than spending your entire Monday scrolling through Meta's ad library (hint: there are Facebook, Instagram and Tik Tok ad spying tools that can help you massively speed up your competitive intelligence, but they’re not absolutely necessary).

Meta just reported third-quarter 2025 revenue of $51.2 billion, up 26% year-over-year, with advertising revenue hitting $50 billion. That's 3.5 billion daily active users and millions of advertisers testing creative every single day. There’s a massive pool of tested, proven creative intelligence just sitting there.

In this guide, we'll show you how to spy on competitor ads the smart way, including how to use a Meta ad spy tool like Atria effectively.

TL;DR: Your competitors are testing creatives with millions in ad spend. This guide shows you how to systematically analyze what's working in your market, identify gaps they're missing, and turn competitor intelligence into campaigns that outperform.

Key takeaways

Use competitor ad intelligence: identify proven strategies and market gaps rather than copying individual ads

Focus on decoding why ads work: hook formulas, psychological triggers, and testing velocity, not just what they look like

Build a systematic monitoring cadence: weekly competitor audits, monthly deep dives, quarterly category reviews

Speed matters: Use competitor intelligence tools to turn insights into tests within hours through ad cloning, script generation, and systematic swipe files by element

Automate your monitoring: tools like Atria to track competitor activity, spot pattern shifts, and access 25M+ ads without manual library scrolling

Why competitor research matters (and why manual research doesn't)

Here's what most marketers are still doing in 2025: opening 47 browser tabs, screenshotting ads into a folder called "inspo" that they'll never look at again, spending hours combing through Meta's ad library or trying to prime the algorithm by searching for products they want to advertise.

The process is painfully manual and a huge time suck. It gives you surface-level insights, at best. It’s not something that will help you create better campaigns. Instead, you end up spending so much time on research that you have no time left to actually ship your next creative iteration.

Copying isn’t smart competitor research. The value is in understanding the landscape, identifying what's working across multiple brands, and spotting the opportunities everyone else missed.

What you need to know about competitor ads

Ad examples are nice. But if that's all you're tracking, you're missing the entire strategy. Focus on:

The creative strategy behind the ads. What hooks are they testing? Are they leading with problem-awareness or jumping straight to the solution? What emotional triggers are they using?

Their testing velocity. How many new creatives are they launching weekly? What's their ratio of video to static? Are they iterating on winners or constantly testing new concepts?

Performance indicators. Which ads have been running for 90+ days? (Hint: those are probably the money-makers.) What creative elements keep showing up in their long-runners?

Target audience and personas. Who are they actually talking to? Are they going after budget-conscious shoppers or premium buyers? New customers or repeat purchasers? What demographics, pain points, and aspirations are they targeting with their messaging?

The full funnel picture. Where are they sending traffic? What's their landing page strategy? How does their ad creative connect to their conversion flow?

How to spy on competitors (step by step)

Let's get tactical. Here's how to systematically analyze what your competitors are doing — and use it to beat them.

Start with discovery

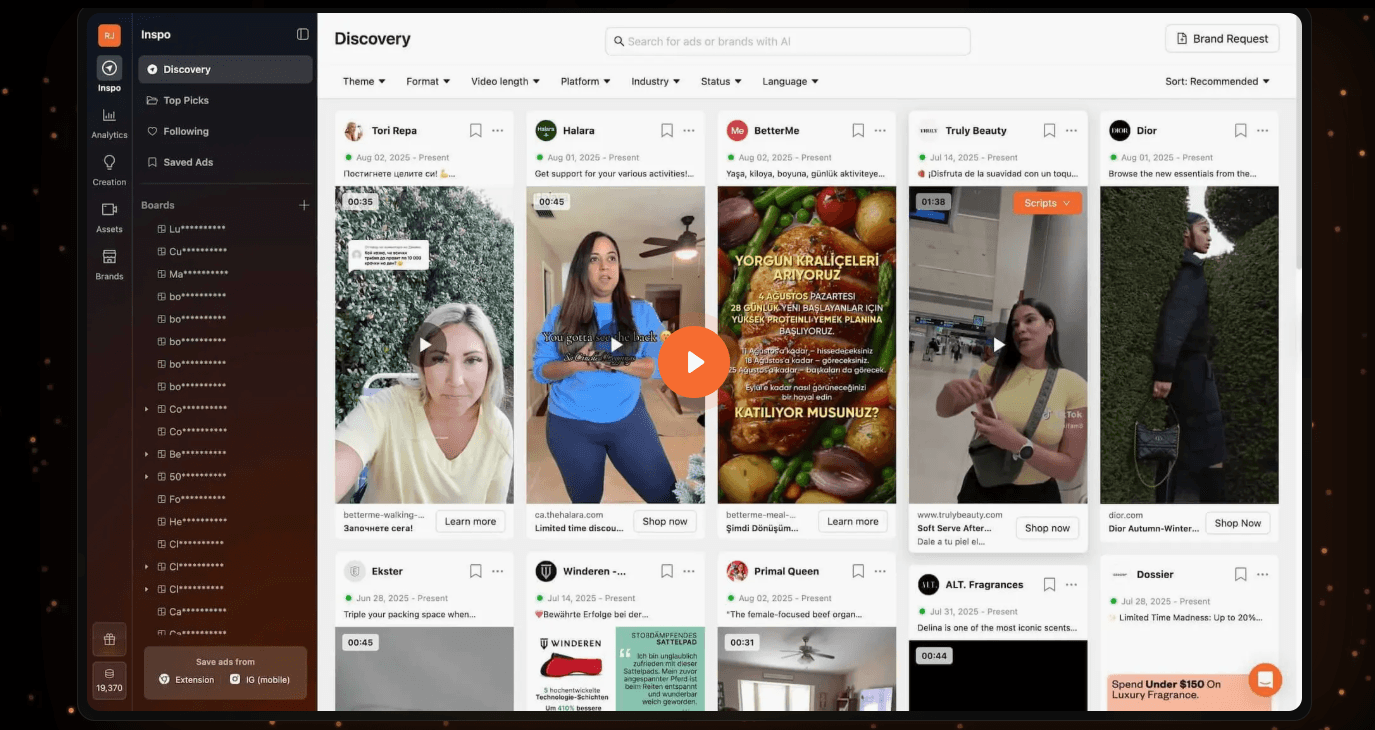

Instead of going straight to a specific competitor, spend time in discovery mode first. Atria's Discovery library gives you access to millions of ads updated daily.

Use this framework to cut through the noise:

Search by keyword, rather than brand names. This is how you find competitors you didn't even know existed.

For example, if you're a beauty brand, don't just search for "competitor skincare brands." Search for the problem you solve: "dark circles," "fine lines," or "acne scars." You'll discover direct-to-consumer brands, dermatology clinics, beauty devices, and supplement companies all competing for the same customer. These are your real competitors.

Filter by your industry to see what the entire category is doing. You might discover that 80% of beauty brands are using dermatologist endorsements right now, or that ingredient-focused ads are outperforming before-and-after shots. This gives you the market context before you zoom in on individual brands.

Look for patterns across multiple competitors. If three brands in your space are all testing UGC-style content, that's a signal. If everyone except one brand is using urgency hooks (limited-time discounts, countdown timers, low-stock warnings) that's also valuable intel.

Sort by longest-running ads. These are the proven winners that have survived the algorithm's brutal natural selection process.

Go deep on your top 3 competitors

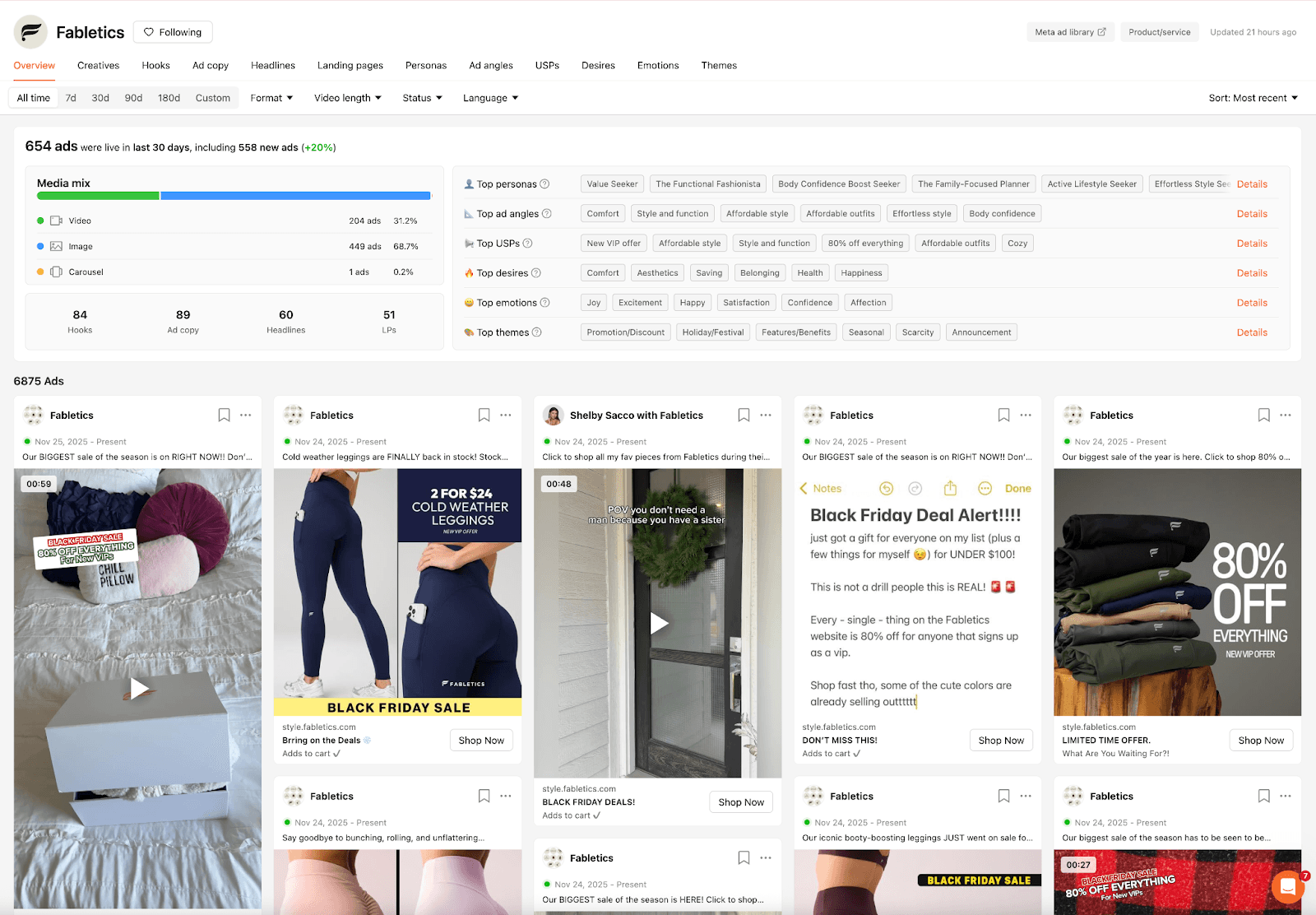

Pick three competitors: your direct rival, an aspirational brand you admire, and an underdog that's growing fast. For each one, you want to understand:

Their creative mix. Pull up their full creative library. What percentage is video versus static? How often are they refreshing creative? Are they testing wildly different concepts or iterating on proven frameworks, like testing five variations of the same before-and-after transformation story?

Their messaging approach. Look at their hooks, headlines, and primary ad copy. What pain points do they hit first? What benefits do they emphasize? How do they handle objections?

Their visual language. Beyond just "what colors do they use," understand their visual strategy. Are they using faces? Product shots? Lifestyle imagery? Text overlays? What's the emotional tone?

DTC skincare brands often lean heavily on close-up face shots with minimal text. Fitness brands crush it with transformation imagery, but meditation apps perform better with calming, abstract visuals.

Their testing patterns. Track when they launch new ads. Is it weekly? Daily? Are they testing in bursts or consistently? This tells you about their resources and strategy.

HiSmile, the teeth whitening brand, had 8,800 ads in Meta's ad library when they were doing $92 million in annual revenue — a sign of aggressive, constant testing. Compare that to brands running 50-100 ads total, and you can see who's in hypergrowth mode versus who's optimizing established winners.

Cutting competitor research timelines in half with Atria

If you’re using Atria for your competitor research, you can easily cut the time you’re spending on competitor research in half, since all you need to do is tell Atria which brands you’re most interested in, then let AI do all the analysis for you.

Here’s the full breakdown of exactly how it works:

Once you follow any brand you discover in the ad library, then access their whole competitive playbook - their creatives, their hooks, their landing pages, personas, ad angles, targeted emotions, USPs and more.

Decode what’s working

People collect ads but don't analyze why they work. That’s where most competitor research falls apart.

For each winning ad you find, break it down:

The hook formula. Is it question-based? Statement? Visual pattern interrupt? Time how long before they mention the product. 63% of advertisers have found that the best time to mention a brand is after the first 3 seconds

The narrative structure. Understanding a brand’s narrative framework helps you adapt it to your own brand without copying.

Here are some ways you could use these common narrative formats.

Problem-agitate-solve: "Breaking out before every big event? You've tried expensive dermatologists, 10-step routines, harsh treatments, and still waking up with breakouts. Our overnight spot treatment uses encapsulated salicylic acid. Dab before bed, wake up to visibly calmer skin."

Before-after transformation: “Before: couldn't do a single push-up, avoided photos, made excuses. After 90 days: completed a 5K, down two sizes, actually looking forward to workouts.”

Social proof story: “Sarah, a Chicago nurse, hadn't slept in three years. First night on our mattress? 8 hours straight. Week two: back pain gone. 50,000+ healthcare workers trust us.”

The psychological triggers. Most winning ads layer multiple triggers.

FOMO: “Only 47 left in stock—restocking in 3 weeks.”

It works because scarcity creates urgency and the fear of losing access drives immediate action over logical deliberation.

Authority: “Developed by Mayo Clinic sleep researchers.”

It works because we're wired to trust experts and defer to credible sources, bypassing our natural skepticism of advertising claims.

Social proof: “Join 2.3 million users who switched this month.”

It works because humans are tribal. We look to others' behavior as a shortcut to making safe decisions, especially when uncertain.

Curiosity: "The $8 ingredient dermatologists don't want you to know about."

It works because our brains are hardwired to close information gaps, making it nearly impossible to scroll past an unanswered question.

The technical execution. Aspect ratio, text-to-visual ratio, pacing, music choice. These details matter for performance.

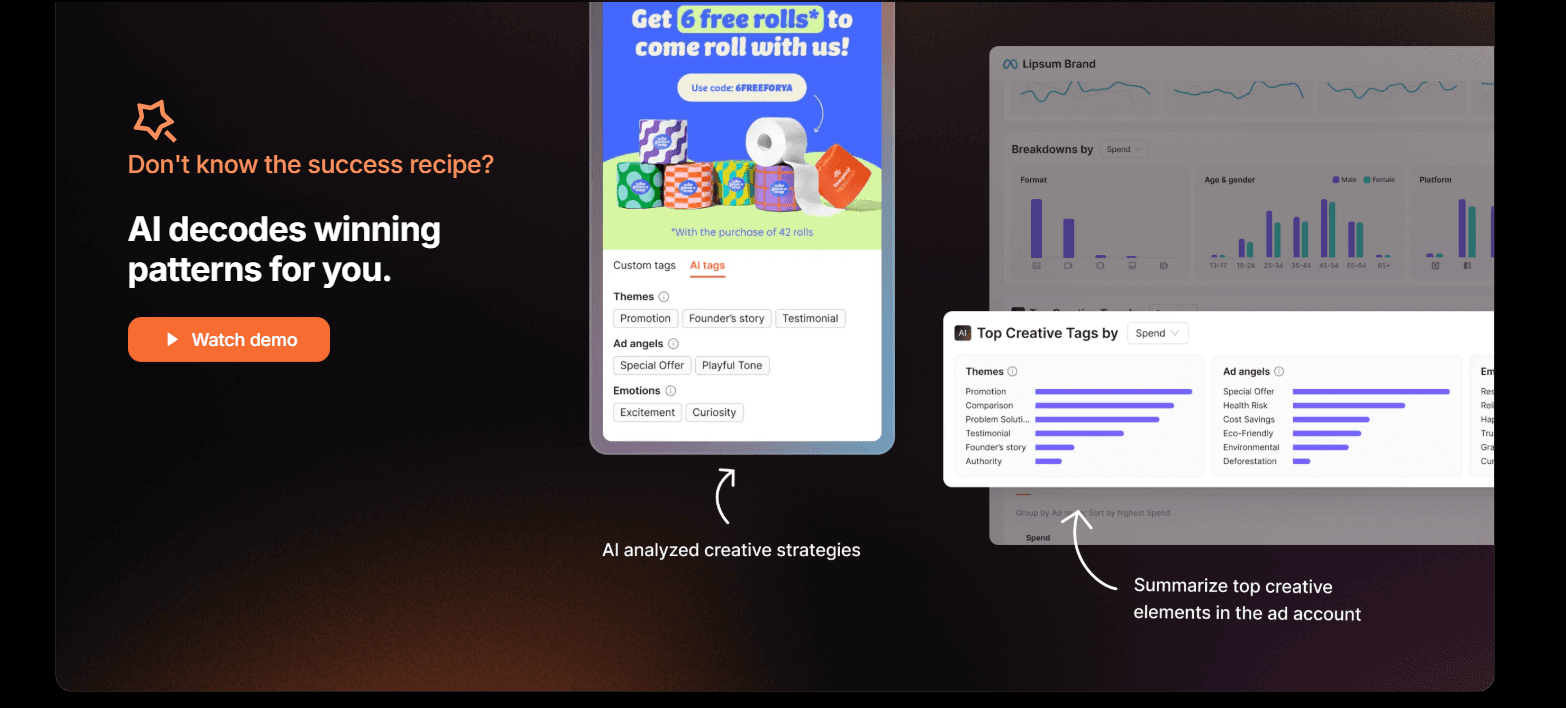

Atria decodes winning patterns for you and summarizes the top creative elements in the ad account.

Turn insights into action

Finding great competitor ads is step one. Here's how to actually use what you learn:

Create swipe files by element Instead of saving "good ads," create collections of "strong hooks," "effective CTAs," "compelling social proof formats." This makes it easier to mix and match elements.

Build testing hypotheses. If a competitor's emotional hook is crushing it, don't copy their exact angle. Test the same emotion with your unique brand voice.

Find the gaps. What aren't your competitors doing? What audiences are they ignoring? What benefits are they not highlighting? These gaps are your opportunities.

Pay special attention to persona and audience gaps. If a competitor is targeting budget-conscious millennials but ignoring premium Gen X buyers, that's your opening. If they're speaking to new parents but overlooking experienced parents with multiple kids, you've found untapped territory. Look for angles they're using that you're not—and angles you could own that they've completely missed.

The founder of canned water brand Liquid Death spotted that water lacked the cool factor at concerts. Concertgoers were drinking water from Monster Energy cans because water lacked the cool factor associated with energy drinks. Liquid Death did the exact opposite of its competitors, using heavy metal branding targeting rebellious youth. Result: $3M to $333M revenue in five years.

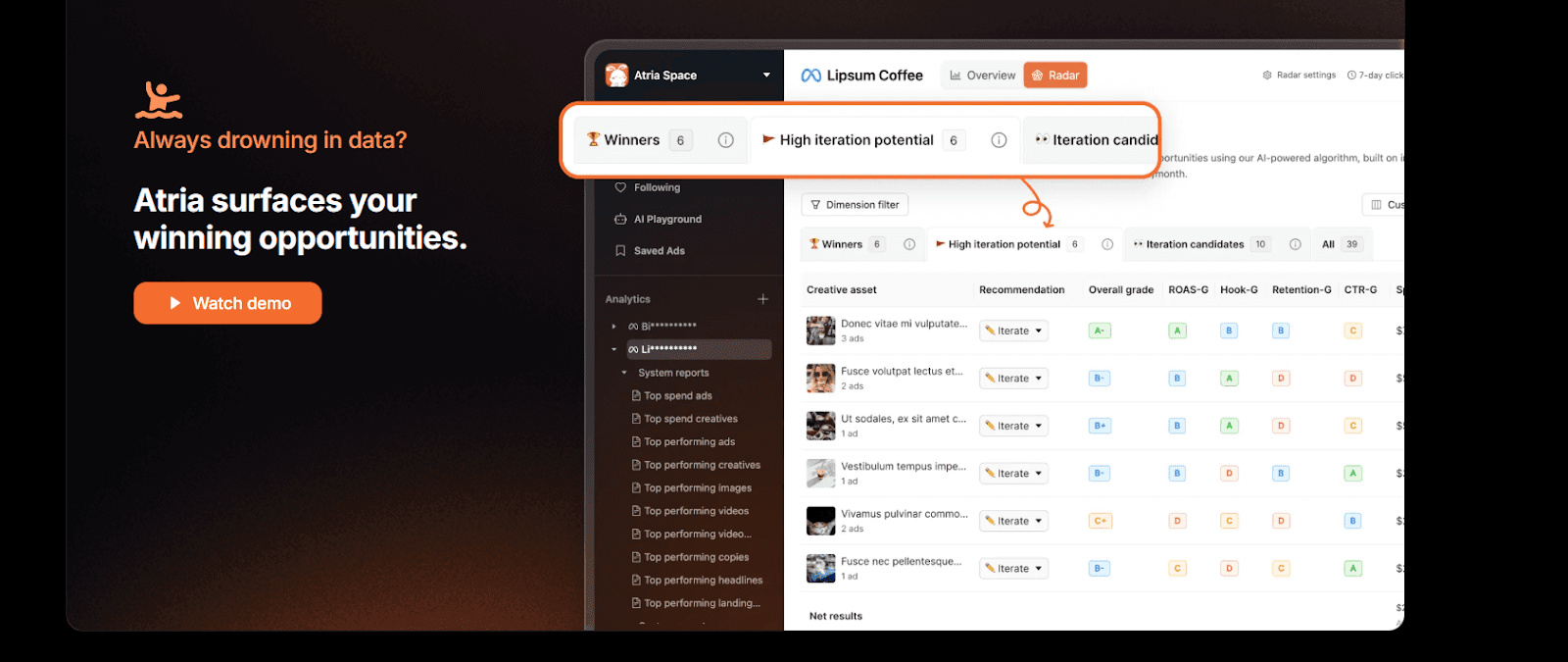

Set up monitoring systems. Manually checking competitors weekly is unsustainable.

Use Atria's tracking to identify when competitors launch new campaigns or shift strategies.

Here’s how:

Brand following with AI-tagged insights: This allows you to follow specific competitors and get AI-analyzed insights about their brand activity

Weekly updates on competitor activity: Keeps you informed about what competitors are doing without manual checking

Ad library with 25M+ ads: You can see competitors' full ad history and compare current vs. past campaigns to spot strategic shifts.

Ad cloning + script generation: Found a winning competitor ad? Clone the creative structure and generate a script adapted to your brand voice. Go from their asset to your own branded version in minutes.

Common mistakes when researching competitor ads

Copying without context. Just because an ad works for them doesn't mean it'll work for you. Different audiences, different brand positioning, different funnel dynamics.

Surface-level analysis. "They use red CTAs" isn't an insight. "They use high-contrast CTAs with urgency language in the final 3 seconds" is actionable.

Ignoring the full funnel. An amazing ad that sends traffic to a terrible landing page is still going to fail. Always look at the complete journey.

Analysis paralysis. Some teams spend so much time researching competitors they never actually launch anything. Set time limits for research phases.

Advanced competitor ad tracking strategies

Once you've mastered the basics, level up with these pro moves:

Track creative fatigue. When do competitors retire ads? Monitor how competitors evolve their creative strategies over time using Atria's competitor tracking. When you notice they're launching new angles or refreshing campaigns, it signals audience saturation in your market.

Monitor seasonal patterns. How do their strategies shift for Black Friday versus summer sales? Build a calendar of their promotional patterns.

Analyze creative testing velocity. If a competitor suddenly 5x their creative output, they might be preparing for a big push or have found a winning formula they're scaling. Tools like Atria show how many active ads a brand is currently running. If a competitor goes from 20 active ads to 100 active ads, you can see that spike.

Building your competitive intelligence system

Most marketers treat competitor research like spring cleaning. Something they do once, feel good about, then forget until six months later when they're scrambling to catch up. Here's how to build a system that actually sticks.

Weekly creative audits. Every Monday, spend 30 minutes reviewing new ads from your top 3 competitors. Look for patterns and changes. Hook changes, new offers, messaging pivots, shifts in format, creative volume spikes, and which old ads are still running.

Monthly deep dives. Once a month, do a comprehensive analysis of one competitor. Go beyond ads to their email marketing, organic social, and broader marketing strategy.

Quarterly landscape reviews. Every quarter, zoom out and look at your entire category. What macro trends are emerging? Who's gaining or losing momentum?

How Atria turns competitor research into action

The best competitive intelligence system is the one you'll actually use consistently. You can't check ad libraries daily, you can't monitor multiple brands consistently, and you definitely can't spot pattern shifts in real-time.

Atria solves this. Instead of spending hours hunting through Meta's ad library, you get instant access to millions of ads with smart filtering by industry, performance indicators, and creative elements. Track your top competitors automatically and identify when they launch new campaigns or shift strategies.

Once you’ve found ads you like, you can deep dive on the brands who launched them in seconds.

Atria isn't just a database. It's built for speed. Find a winning competitor angle, analyze what makes it work, and get your own test live within hours. The brands winning at paid social move fast from insight to execution.

Turn competitor research into your unfair advantage

Your competitors are running hundreds of creative tests with millions in ad spend. They're essentially doing expensive research for you. Not leveraging these insights is like ignoring free market research.

But remember, the goal isn't to become a copy of your competitors. Understand what's working in your market, spot opportunities they're missing, and create something uniquely yours that performs even better.

The smartest brands learn from their competitors, iterate on what works, and ultimately create campaigns that make their competitors want to spy on them.

Ready to level up your competitive intelligence? Stop manually scrolling through ad libraries and start getting actionable insights in minutes. Your competitors won't know what hit them.

Frequently asked questions

Here are the most common questions we get about competitor ad tracking.

What exactly is competitor ad tracking, and why is it important for my marketing strategy?

Competitor ad tracking monitors what ads your competitors are running, how often they test new creative, and which campaigns run longest (indicating success). It's important because it reveals proven strategies in your market, helps you spot gaps to exploit, and prevents you from wasting budget testing angles that already failed for others.

How can I analyze my competitors' ads without directly copying their ideas?

Focus on understanding why ads work, not just what they look like. Break down hook formulas, narrative structures, and psychological triggers. Use a tool like Atria to spot patterns across multiple competitors, then adapt those insights to your unique brand voice and audience.

What is "creative fatigue" and how can I monitor it?

Creative fatigue is when your audience sees an ad too often and stops engaging with it. CTR drops, CPMs rise, performance tanks. Monitor it by tracking when engagement metrics decline on specific ads, watching how long competitors run ads before retiring them, and noting when they refresh creative to combat saturation.

What are the most important metrics to look at when analyzing competitor ads?

Focus on ad longevity (90+ days signals winners), creative volume (testing velocity), format mix (video vs. static ratio), hook patterns, and landing page destinations. Don't just track what they're running, but also how often they refresh, what they retire, and which messages they iterate versus abandon.

What common mistakes should I avoid while researching competitor ads?

Don't copy without understanding context. What works for one brand may not work for your audience. Avoid surface-level analysis like "they use red buttons." Always check the full funnel, not just the ad. And don't get stuck researching forever; set time limits and actually launch tests.

How often should I monitor my competitors' ad campaigns, and what should I look for?

Check your top 3 competitors weekly for new ads, creative shifts, and messaging changes. Monthly, do a deep dive on one competitor's full strategy. Quarterly, review your entire category for macro trends. Focus on what's running 90+ days (proven winners), testing velocity spikes, and gaps in their approach.

What is the best free Facebook ad spy tool?

Meta's free Ad Library is the best starting point. It shows all active ads from any advertiser on Facebook and Instagram. However, it doesn't save historical data or provide AI analysis. For serious competitive research, tools like Atria offer deeper insights including hook analysis, creative breakdowns, and the ability to track competitors over time.

Can you see how much a competitor spends on Facebook ads?

Not directly. Meta's Ad Library shows ad ranges for political ads but doesn't reveal spend data for commercial advertisers. However, you can infer relative spend by tracking how many ads a brand runs simultaneously, how long ads stay active (longer-running ads typically have positive ROI), and their testing velocity. Tools like Atria help you spot these patterns automatically.